1031 tax deferred exchange meaning

1031 Into REIT Yes You Can. While arranging Section 1031 exchanges can be complicated the tax savings can be well worth the trouble.

Are You Eligible For A 1031 Exchange

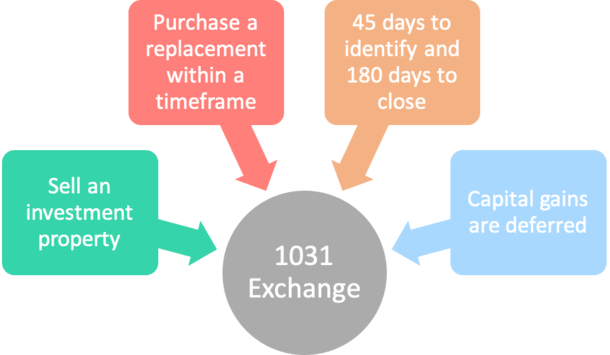

The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished properties for one or more like-kind replacement properties.

. Browse Get Results Instantly. What Is a 1031 Exchange. 1031 Tax-Deferred Exchange Definition For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for.

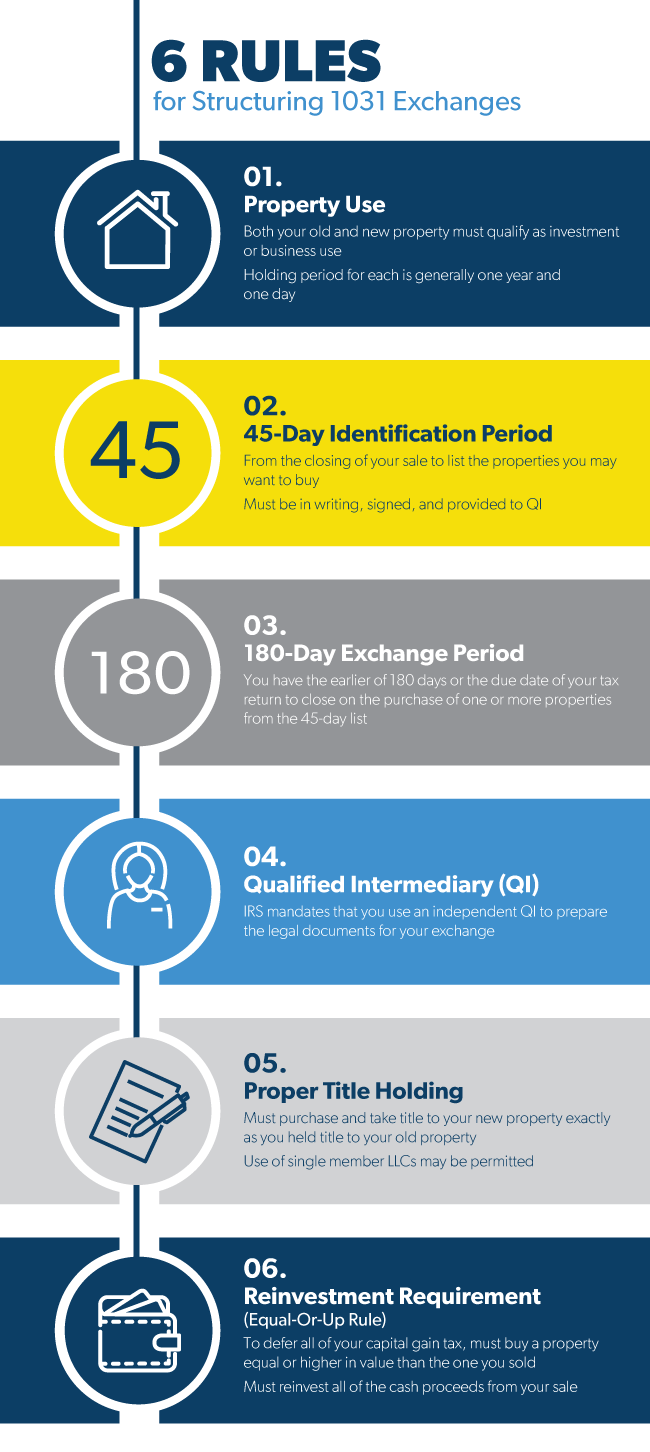

Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow. The exchange can include like-kind property. As with all of the tax deferral strategies there are certain rules to follow so that.

A 1031 exchange also called a like-kind exchange LKE The landmark legal decision of TJ. 721 UPREIT Exchange Properties. This post was co-authored with John Starling Senior Vice President Northern 1031 Exchange LLC.

1031 Tax Deferred Exchange Explained. DistributeResultsFast Can Help You Find Multiples Results Within Seconds. By completing an exchange.

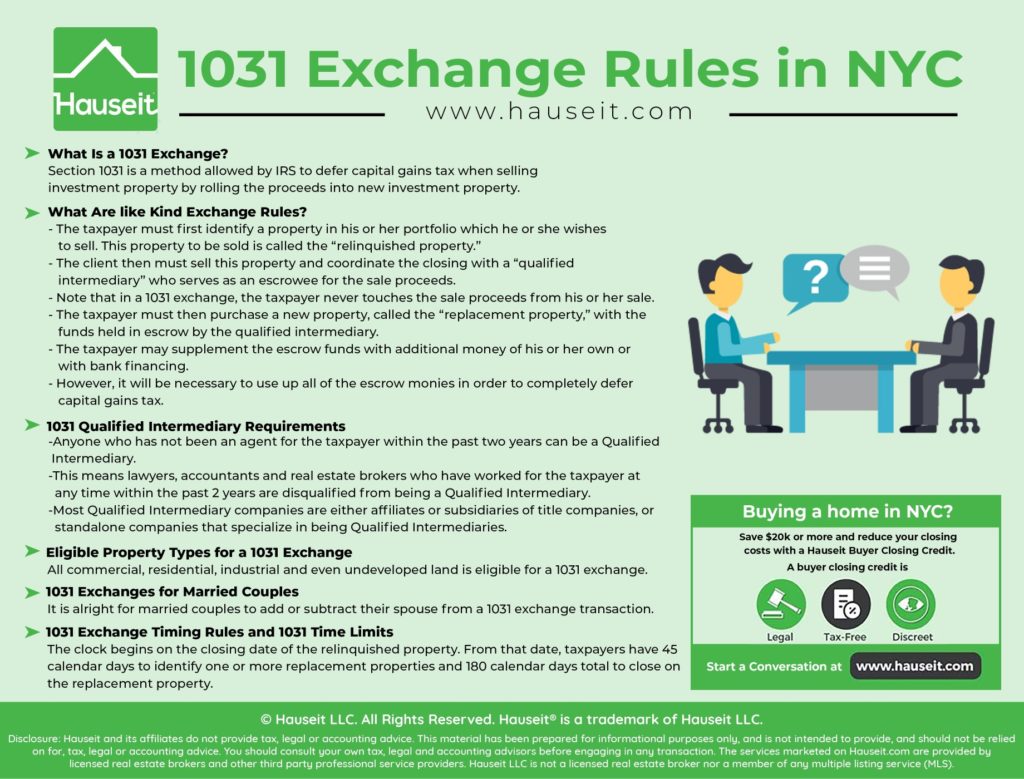

1031 Exchange 1031 tax deferred exchange Under Section 1031 of the IRS Code some or all of the realized gain from the exchange of one property for a like kind property may be deferred. Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow. 1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange.

Ad Defer capital gain tax with an Orlando vacation home as 1031 replacement property. 1031 Exchanges are complex tax planning and wealth building strategies. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while.

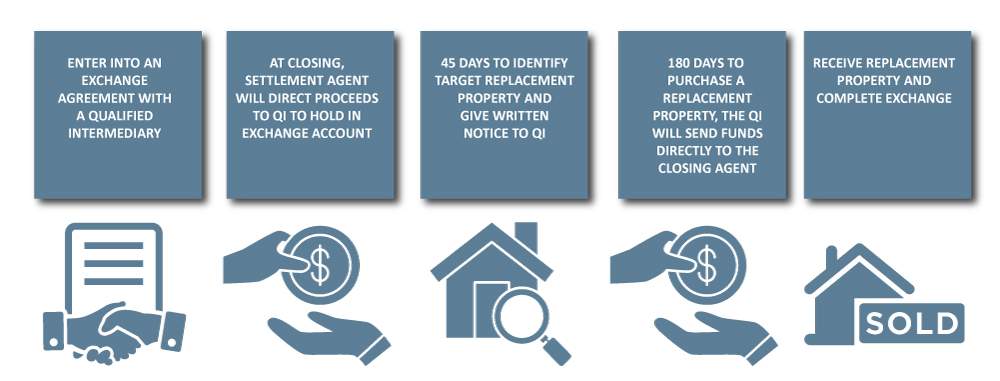

Under Section 1031 of the United States Internal Revenue Code 26 USC. The property South Carolina investors sell and the replacement property they purchase must meet certain requirements to qualify for a 1031 Exchange. Section 1031 states that any proceeds from a sale of real estate remain taxable unless handled by a qualified intermediary which then transfers the funds to the other seller s of the.

721 UPREIT Exchange Listing. No-hassle passive income now. 721 UPREIT Exchange Listing.

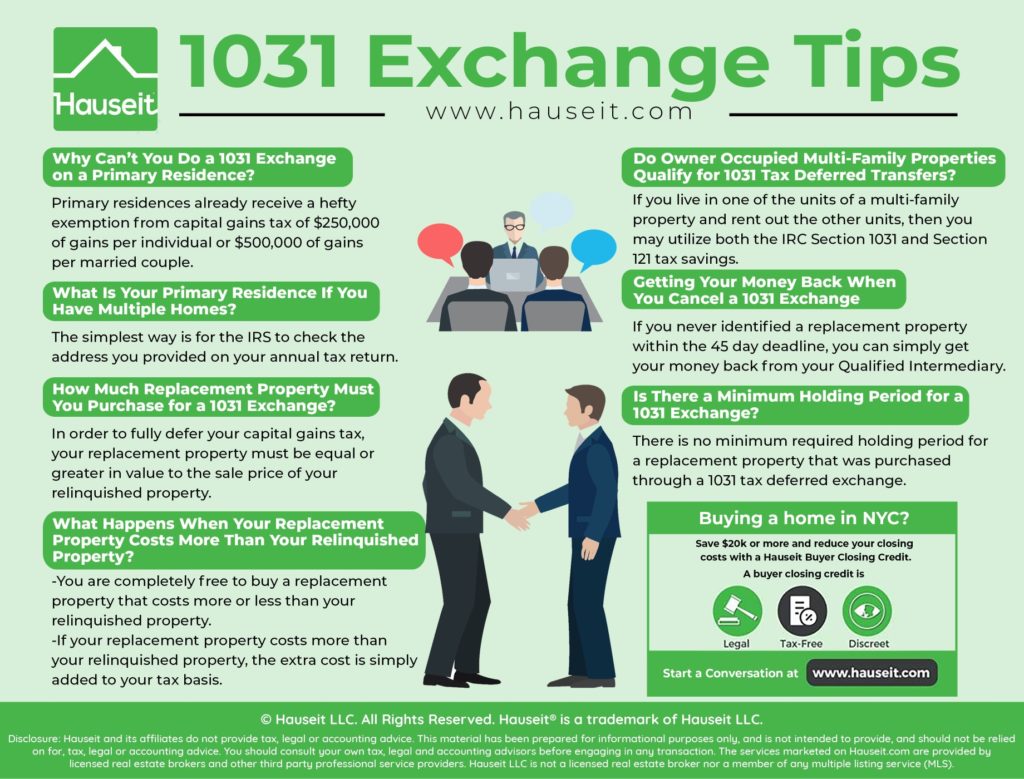

Why deal wtenants toilets trash. Both properties must be held for use in a. If you own investment property and are thinking about selling it and buying another property you should know about the 1031 tax-deferred exchange.

This is a procedure that allows the owner. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. No-hassle passive income now.

The termwhich gets its name from Internal. What Is A 1031 Tax Deferred Exchange. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.

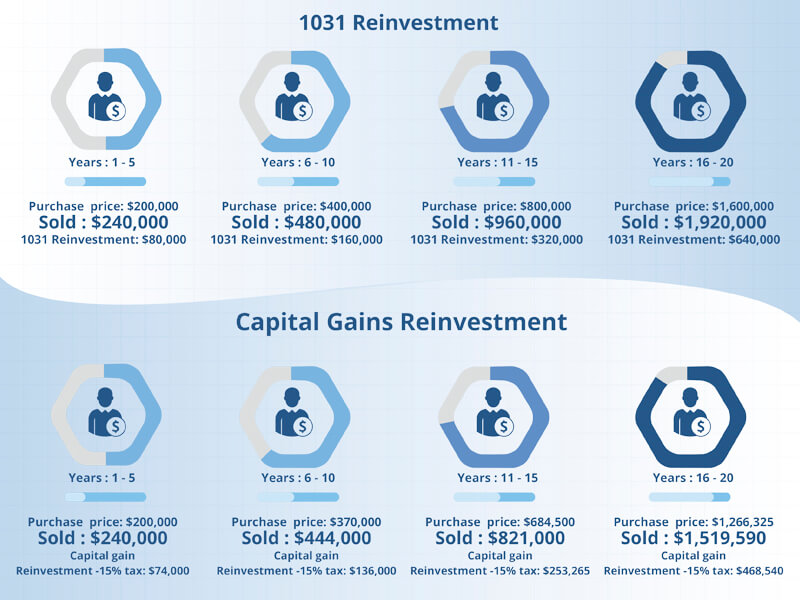

A 1031 exchange allows you to defer gains taxes on a property that you sell. Those taxes could run as high as 15. Ad Request Information On Unique 1031 REIT Exchange Programs.

In summary a 1031 exchange is a way to defer the payment of these taxes- thats why it is referred to as a 1031 tax-deferred exchange. The 1031 Exchange allows you to sell one or more appreciated rental or. A 1031 Tax Deferred Exchange is when a property owner sells their qualified property - known as the relinquished property - and reinvests the proceeds into another property or properties.

Get your tax advisor involved to avoid pitfalls. Why deal wtenants toilets trash. Understand the benefits of the Orlando short term rental market for your 1031 exchange.

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred but it is not tax-free. 1031 Into REIT Yes You Can. Ad Request Information On Unique 1031 REIT Exchange Programs.

The deferred 1031 exchange gives you time by allowing you to sell your first property to an intermediary who then buys the property on the other end of the exchange at a later date. By Randy Kaston on March 29 2022. So check the contract again to verify.

Ad Search For Info About 1031 tax deferred exchange. 721 UPREIT Exchange Properties. Basically a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits.

A 1031 Exchange also commonly called a Like-Kind aka Starker or Deferred Exchange refers to Section 1031 of the Internal Revenue Code that provides for the tax-deferred. 2d 1341 9th Cir. It simply means that you agree to let them perform a 1031 exchange which starts with the sale - not that you have to help them finish.

Section 1031 of the US. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. 1979 was significant in the development of the 1031.

As part of a qualifying like-kind exchange. Sometimes people say tax-free exchange but. Tax code defines a 1031 exchange as a like-kind exchange of one investment property for another in which capital gains tax liability is deferred.

6 Steps To Understanding 1031 Exchange Rules Stessa

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

1031 Exchange Explained What Is A 1031 Exchange

What Is A 1031 Exchange Properties Paradise Blog

1031 Exchange How You Can Avoid Or Offset Capital Gains

Irc 1031 Exchange 2021 Https Www Serightesc Com

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

1031 Exchange What Is A 1031 Exchange Mark D Mchale Associates

1031 Tax Deferred Exchange Explained Ligris

1031 Exchange Faqs 1031 Exchange Questions Answered

What Is A 1031 Exchange Asset Preservation Inc

How To Do A 1031 Exchange In Nyc Hauseit New York City

6 Steps To Understanding 1031 Exchange Rules Stessa

1031 Exchange Rules Tax Deferred Exchange Manhattan Miami

How To Do A 1031 Exchange In Nyc Hauseit New York City

1031 Exchange The Basics Take Me Home Bend The Source Weekly Bend Oregon

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

Definitions And Rules Of A Deferred 1031 Exchange Republic Title

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules